Affordable Support of Your Trading Ambitions We can help you to analyze your stock trading strategy

What you get

For back testing:

- Detailed trading strategy test report (PDF) which includes:

- Sharpe ratio

- Total return

- Number of trades

- Number of long trades

- Number of short trades

- Number of winning trades

- Number of losing trades

- Average trade duration

- Average number of trades per day

- Maximum drawdown

- Maximum intraday gain

- Maximum Intraday loss

- Charts of each trade (if you choose to include them). Charts can be customized for you.

- Monte Carlo simulation results (if you choose to include it):

- Number of scenarios

- Summary chart of returns distribution

- Average return ($,%)

- Average max drawdown ($,%)

- Return to drawdown ratio

- Number of times account was ruined (minimum balance achieved)

- “with probability of X% your strategy’s return will be at least Y%”

- List of all trades in CSV format (you can open it in Excel). You can request any columns for this file. It is convenient if you want to analyze how changing certain parameters impacts the overall result. Beware of over fitting while tweaking your parameters and trying to maximize your hypothetical gain.

If you subscribe for live alerts:

- We will set up our system to scan the market for you.

- Once the market situation satisfies the criteria you’ve defined, the system will send an instant e-mail alert to you. Content of the alert can be customized for you.

Subscription cost will depend on complexity of your strategy. Send us your request here, and we’ll provide you a free quote.

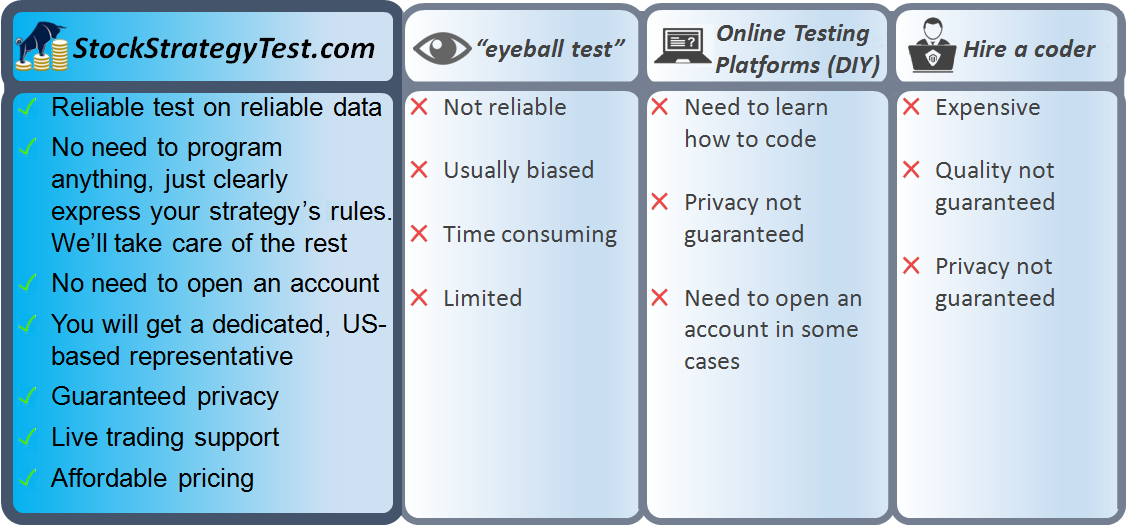

Our advantage

F.A.Q.

Q. What kind of trading strategies you can analyze?

We specialize on intraday, swing, and buy-and-hold stock trading strategies. We don’t work with HFT. We can perform historical testing on any ticker intervals which are more or equal to one minute.

Q. How much it will cost?

Our pricing depends on complexity of your strategy. We use our unique semi-automated testing platform, so we can maintain very affordable pricing for our customers. Average price for pure back testing is $140. Average cost for live testing alerts – $70 one time set-up fee, and then $60 monthly subscription, but, again, price depends on particular strategy

You can always get a free quote – just fill the form here.

Q. Can you test strategies on ticker interval below 1 minute?

Currently, we can’t do back testing of such strategies. However, we can setup live testing alerts for you. We can monitor stock prices every second if your strategy requires it.

Q. What is the difference between live testing alerts and live trading alerts?

Alerts are the same and the logic behind them is the same. Once you set up live testing with us, you can just keep it for live trading. There is no additional fee or any kind of transition. Only you decide when you want to start live trading.

Q. Can you sell your data?

Yes. If you are interested – contact us.

Q. Can you help to build an automated trading strategy?

Yes. If you are interested – contact us.

Can I customize the charts for the report?

Absolutely! Add any parameters you want.

Can you analyze a portfolio of strategies?

Yes! Contact Us